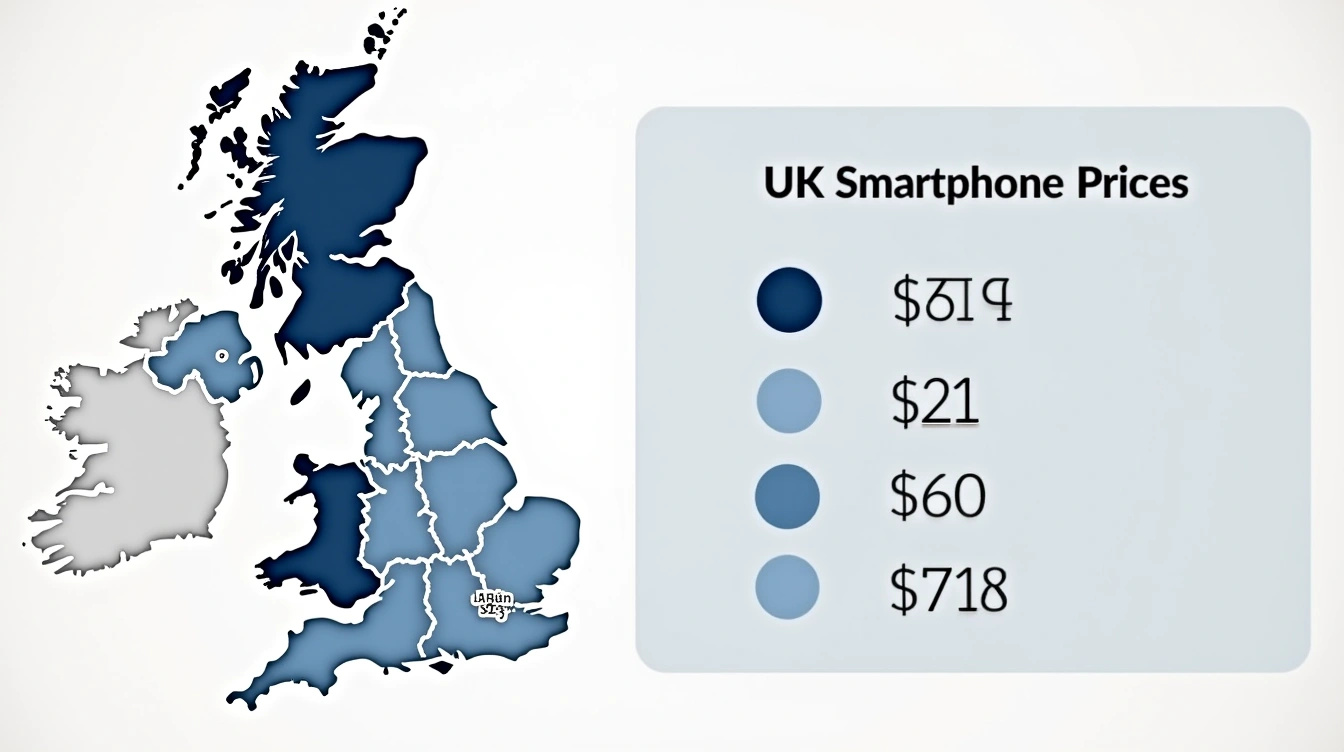

UK Smartphone Prices Compared to Major European Markets

Analyzing how the UK stacks up in smartphone pricing across Europe

When examining UK smartphone prices, recent data reveals that the UK generally offers slightly higher average prices compared to many major European markets. The European smartphone market is diverse; countries like Germany and France often showcase more competitive pricing due to larger market scale and stronger carrier subsidies.

Also read : How are UK smartphones driving innovation in computing?

For instance, a smartphone price comparison indicates that average device costs in Spain and Italy tend to be lower than in the UK, reflecting different demand patterns and retail strategies. Meanwhile, Nordic countries — known for high living costs — sometimes exhibit pricing comparable or even exceeding that of the UK.

Key surveys highlight that UK consumers pay a premium, often linked to factors such as import taxes and marketing costs. UK prices can be as much as 10-15% higher than those observed in France or Germany, making careful comparison essential for buyers.

Have you seen this : What are the economic impacts of smartphone manufacturing in the UK?

Understanding these regional price variances helps consumers make informed decisions about smartphone purchases and can explain why some opt to buy abroad or through carriers with aggressive promotions. This context is critical when navigating the complex landscape of the European smartphone market.

Price Breakdown by Popular Smartphone Brands and Models

Understanding Apple iPhone price Europe, Samsung smartphone prices, and Google Pixel prices offers valuable insight for buyers navigating diverse markets. Across Europe, Apple iPhones consistently command premium positioning, especially flagship models like the iPhone Pro series, often priced higher than Samsung’s equivalent Galaxy S line or Google Pixel flagship devices. This reflects Apple’s brand positioning and demand.

Flagship models from Samsung often showcase competitive pricing strategies in Europe, with prices slightly lower than Apple’s flagship iPhones but still positioned at the high end. Google Pixel prices tend to be more moderate, appealing to buyers seeking quality cameras and stock Android experiences without the flagship price tag observed in Apple or Samsung devices.

Mid-range smartphones from these brands show more significant differences by country in Europe. Factors like import taxes and retail competition impact Samsung and Apple mid-range prices more variably, while Google maintains relatively consistent pricing across markets.

Data on pricing was gathered from official brand retailers and reputable online platforms, allowing for an accurate and comparative view. This helps buyers make informed decisions by weighing benefits alongside cost differences in Europe’s diverse smartphone ecosystem.

Key Factors Affecting Price Differences Across Europe

Price variations for smartphones across Europe are largely influenced by VAT and taxes on smartphones, which vary significantly from one country to another. For example, VAT rates can range from around 17% in some countries to over 27% in others, directly impacting the cost consumers pay at retail. Higher VAT inevitably raises smartphone prices, making this a key factor when comparing costs.

In addition to taxes, import duties UK vs Europe also play a crucial role. Post-Brexit, the UK faces different tariffs and customs procedures than EU countries, which can increase smartphone prices in the UK relative to mainland Europe. These import duties can add additional fees, affecting the final retail price.

Currency exchange rates further complicate pricing differences. Fluctuations between the British pound and the euro, or other European currencies, influence pricing strategies by manufacturers and retailers. When the pound weakens, UK prices might rise even if the base price remains the same.

Local regulations and the degree of market competition also affect prices. Countries with stricter regulations or less competition tend to have higher retail prices. Thus, understanding VAT and taxes on smartphones, import duties, and currency exchange is crucial when evaluating smartphone prices across Europe.

Additional Costs and Market Trends Shaping Prices

Understanding smartphone market trends in Europe involves examining how pricing structures differ between carrier contracts and SIM-free options. In the UK, SIM-free prices typically reflect the true cost of a device without the influence of subsidies. Carrier subsidies often lower upfront payments but increase the total expense across contract lengths. This pricing approach can obscure the actual value of a handset.

Recent years have seen notable shifts in consumer demand that directly impact device prices. As consumers increasingly favor flexibility, SIM-free phones have gained popularity, encouraging manufacturers and retailers to adjust pricing strategies accordingly. Launch cycles also play a crucial role. New model releases can temporarily suppress prices of older devices, while premium models maintain higher price points due to advanced features.

Price movements reflect a complex interplay of these factors. While some flagship smartphones experienced gradual price stabilization, mid-range devices saw competitive pricing due to growing market saturation. Additionally, economic considerations, such as inflation and supply chain disruptions, have introduced unpredictability in pricing trends across European markets. Staying informed about these smartphone market trends in Europe helps buyers make smarter decisions between carrier-linked or SIM-free purchases.

What the Data Says: Authoritative Sources and Findings

Delving into smartphone price reports Europe reveals consistent themes across official statistics and credible market research. Leading institutions like Statista, IDC, and Eurostat provide robust, data-driven insights on pricing trends, market shifts, and consumer behavior. For example, Statista’s latest reports indicate a gradual increase in average smartphone prices in Europe, driven primarily by enhanced flagship models and growing demand for 5G technology. IDC’s comprehensive analyses highlight that mid-range devices remain the backbone of sales volume, influencing overall price averages.

Eurostat offers official statistics that complement market research by focusing on regional price variations and purchasing power parity, helping paint a clearer picture of how consumers across Europe access smartphones differently. Industry experts emphasize that while high-end models grab headlines, affordability and market segmentation dictate price dynamics.

Consulting these credible market research reports and official statistics can offer a grounded understanding of smartphone pricing in Europe. For those seeking further details, official channels like Statista or IDC serve as reliable sources for continuous updates on evolving trends and forecasts within the smartphone sector.

Understanding Precision and Recall in SQuAD

In the Stanford Question Answering Dataset (SQuAD), evaluating model performance relies heavily on two key metrics: precision and recall. These help measure how accurately the model predicts answers compared to the correct responses.

Precision is calculated by dividing the number of true positive tokens (tp)—the tokens appearing both in the model’s prediction and the correct answer—by the sum of true positives and false positive tokens (fp). False positives are tokens predicted by the model but not present in the correct answer. Mathematically, precision tp / (tp + fp). This tells you how many predicted tokens were relevant.

Recall, on the other hand, focuses on coverage. It’s the ratio of true positives to the sum of true positives and false negatives (fn)—tokens in the correct answer that the model missed. Formally, recall tp / (tp + fn). This indicates how much of the correct answer the model was able to capture.

Optimizing both precision and recall ensures the answer not only contains the correct words but also omits irrelevant text, striking a balance vital for high-quality question answering systems.